Consumer spending has always been a moving target—unpredictable and ever-evolving. However, the pace of new behavior seems to be moving at breakneck speed for several reasons.

At Alliant, data best practices enable us to mediate anomaly spend behaviors and reduce their impact on data strategies and models in non-anomalous times, while appreciating the learnings that such anomalies provide. This approach empowers marketers to have the agility to match what’s happening in the real world.

Recent Insights from Alliant's DataHub

In analyzing consumer buying trends from the last five years across the Alliant DataHub, a member fed data cooperative, we’ve uncovered some interesting insights to help guide marketing strategies, both today and into the future.

There’s been a host of recent factors that have contributed to the acceleration of the next normal of consumer behaviors. Some of the most notable include the post-COVID landscape, economic inflation, new advances in technology, and millennials and even Gen-Z coming of age across different key life stages. It is important to note, that shifts in the DataHub are also reliant on the additions of new Members and their transaction history.

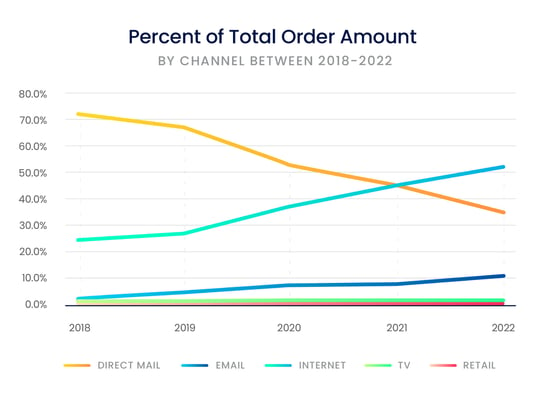

Overall, consumers continued to spend throughout the pandemic, but their spending levels have waned over the past year as economic uncertainty has set in. And notably, consumer spending has shifted significantly by channel. Since 2019, total order amounts by channel have shifted in the following ways:

- Direct mail spend has decreased by 24.40 percent.

- Email spend has increased by 224.13 percent. (Who said email marketing was dead?)

- Online channel spend has increased by 185.41 percent.

- TV spend has increased by 167.86 percent.

- Retail spend has decreased by 98.53 percent.

From a vertical perspective, Auto, Financial Services, and Home Services saw ~40 percent increases in the pandemic, but post-pandemic, the story differs by category. While we’ve seen a significant decrease in orders for Auto and Financial Services (and others, like Non-Profit), Home Services continues to grow. Similarly, the Crafts & Children/Parenting vertical increased during the pandemic, but orders have returned to pre-pandemic levels. According to recent data from McKinsey, overall consumer spending growth is slowing, but consumers still intend to splurge on select categories, like food, apparel, and travel.

As we drill down into verticals, this is where it becomes even more imperative to have accurate and stable data. Within each vertical, there are real-world events that play a role in consumer spending increases or decreases that can vary greatly across different demographics, levels of income, geographical locations, and more.

The Impact of Real-World Changes on Today's Data Models

So how does this affect today's data models? And to what extent? As you might imagine, that depends on how a brand handles its data.

One of the biggest shifts due to the pandemic is advances in delivery apps, and younger consumers driving the explosion in meal and food delivery services. So how does this particular example manifest itself in the world of data? The Alliant DataHub displayed an increase for these businesses in terms of average dollar amount, recency, and frequency of orders due to the increase of monthly and weekly subscription orders. This trend persisted until more recently, when with consumer spending tightening, subscription orders began to decline dramatically as consumers tightened spending.

Fortunately, Alliant data models distinguish between subscription and one-shot orders, as well as incorporate recency of consumer behavior, anywhere from 90 days to seven years depending on the use case. This kind of detail and discernment is important when informing models that are effective and stable under a variety of conditions. In this case, the differentiation of order types, and considering a longer history of consumer spend, means to the models, and marketers, can connect the dots between pre- and post-pandemic sales trends.

Best Practices for Real-World Consumer Spend Data

So, what learnings can marketers apply when it comes to balancing factors like pre- vs. post-pandemic shifts and inflation on consumer spending data? Best practices include relying on aggregate factors of purchases, interest propensities, and shopping-related behavior that span across years. Case and point, marketing decisions shouldn’t be made based on sudden increases or decreases in spending that occurred right around an anomaly event like the pandemic.

When an irregular event occurs, data providers must operate under a heightened awareness of the possibility of a model being biased. A rigorous QA program along with examining model scoring prior to audience deployment can help avoid biased models.

Good data providers factor in a range of information that can capture actionable insights across life stage changes like becoming new parents to massive purchases such as homes and vehicles to new interests via e-commerce activity, and more to predict behavior. Marketers can enhance the customer experience by working closely with data and analytics partners to regularly evaluate models, retraining with new data sets regularly.

5-7+ Years' Worth of Data is Important

Many of Alliant's solutions rely on five years of aggregated transactions. If a consumer was interested in women’s apparel five years ago, it is likely they still are. These types of features are stable and robust. But not all features are, remember a consumer’s likelihood to subscribe and then cancel? Five-to-seven-year histories create stability no matter what but can also be complemented by two-year, one-year, and 90-day features for brands looking to zero in on the more recent and variable behaviors.

For business leaders and marketers who rely on historical buying data to guide their decision-making, rapidly changing economic and social factors can present challenges—but also opportunities. Understanding history allows us to chart our futures, and reflecting on the ebb and flow of consumer behavior can help us to thoughtfully predict what might come next — “anomalies” included. Ensuring you have data and analytics partners, internal or external, that are carefully categorizing and time stamping data, will help to ensure you have the detail and depth to continue to produce stable predictive solutions that drive ROI in your campaigns.

Interested in learning more about data strategies and advanced data modeling? Feel free to reach out to us and our team will be in touch!

Submit a Comment